Costs also vary depending on the size of your business turnover, the value of your invoices and, of course, if you present any risk. It’s important to note that factoring fees will vary depending on the factoring company. This charge includes debt collection and sales ledger management.

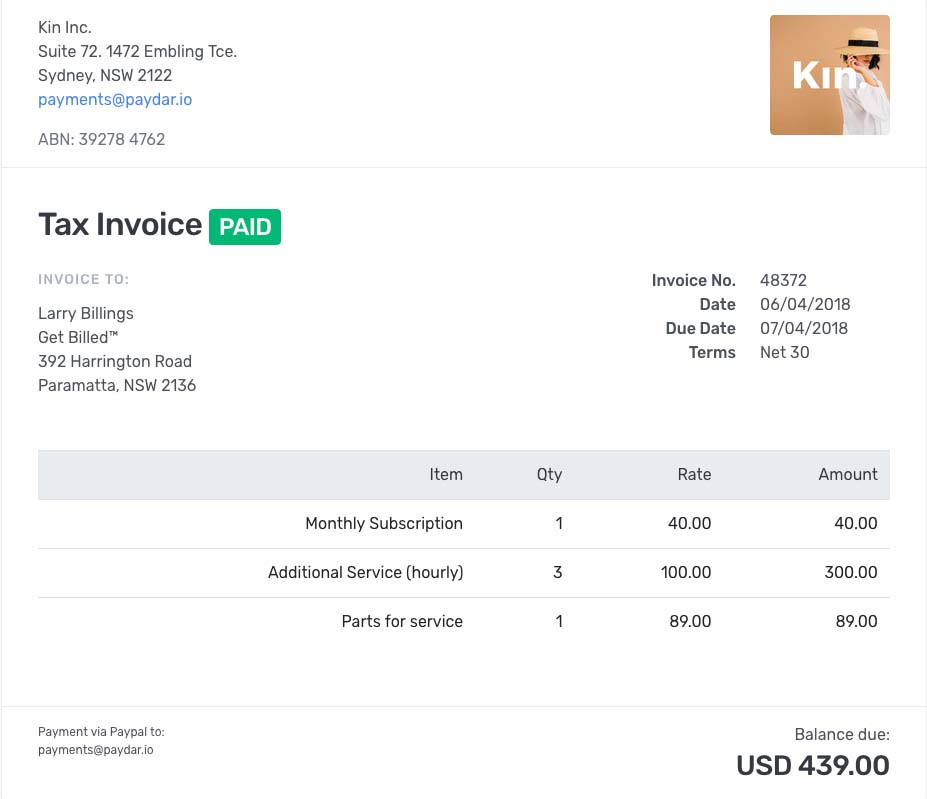

The other is a “management/service charge”, this fee can range anywhere between 0.5% and 3% or more of your annual turnover. The first is called a “factor rate” and costs between 1-5% of the invoice value. There are two costs to consider with debt factoring. No confidentiality - as the factoring company will chase customers for payment, you have to tell your customers you’re working with them. Invoice factoring is expensive – but if your business has high-profit margins, you can absorb this cost, making it a worthwhile investment. Handing over credit control can damage relationships – having a third-party come and chase customers for payments might damage your relationships. Less admin work for you – with debt factoring, the factoring company manages your credit control, so there’s no need to worry about chasing customer payments, it’s all done for you. Quick access to cash – you don’t have to wait around for your customer to pay your invoice. Predictable cash flow – pay wages on time every time, invest in new markets, buy more stock. So, what are the advantages and disadvantages of debt factoring? The advantages of invoice factoring What are the advantages and disadvantages of invoice factoring?Īlthough invoice factoring, or debt factoring, can be a dependable source of cash for any SME, it’s crucial to weigh up the pros and cons before making a final decision. Just think of all the great things you could do with that cash for your business! You can release up to 95% of your unpaid invoice amount. Sell a percentage of the total invoice value and pay a fee to the factoring company for the privilege of fast cash. You can relax, knowing you can access funds tied up in the unpaid invoice almost instantly through a factoring company.Ĭash flow is a problem that plagues many UK SMEs, but with invoice factoring, you don’t need to lose sleep over unpaid invoices. But you could really do with the money now to inject into your business, or to pay staff wages – in this scenario, invoice factoring takes the heat off. Let’s say you invoice your customer who owes you £50,000, and you won’t receive this payment for another 90 to 120 days. But how does it work? Read on to find out. You can use your immediate funds for anything business-related. Many companies also use invoice factoring to release large sums of money to inject into a new project or expand into new markets. It’s a great way to promote healthy cash flow, which means you’re never behind on paying bills, rent, or staff wages. Your customer pays the factoring company, they take their fees off and release the remainder back to you. You sell the invoice amount to a factoring company, which then releases the funds to you.

Invoice factoring presses fast forward on this process, by granting you access to up to 95% of the unpaid invoice amount quickly.

But when you invoice your customer, you have to reside yourself to the fact that payment can take a long time. And it’s a way for businesses to release funds against an unpaid customer invoice or your entire debtor book.Įveryone likes getting paid it’s a pretty good feeling. Invoice factoring, sometimes known as debt factoring, is a form of invoice finance.

0 kommentar(er)

0 kommentar(er)